Basic AI Chatbot Pricing: A simple chatbot that can answer questions about a product or service might cost around $10,000 to develop.

Read More

![]() Location :

Orlando, FL, USA

Location :

Orlando, FL, USA

Company

About Us

From humble beginnings to distinct milestones, We have made history.

Biz4Group - Your Trusted Advisor

Providing detailed architecture diagrams, design guidelines, regular status updates, review calls, best coding practices, advanced deliveries, product enhancement insights, and comprehensive post-deployment support.

20+

Years of Experience

200+

Dedicated Professionals

700+

Successful Projects

300+

Happy Clients

Career

Golden Opportunity For Unconventional Thinkers! We have made history.

Job Openings

Mail Your CV at : hr@biz4group.com

Leadership

Our Leadership Team Crafting the Future of Business with Visionary Leaders

Chief Sales Officer

Board of Director

Technology Director

CTO

Technical Director

Chief People Officer

Founder & CEO

AI Products

Customer Service AI Chatbot

Achieve 50% increase in agent productivity and 80% in CSAT.

Features

Support Ticket Labeling

Efficiently categorizes customer inquiries for streamlined support & faster response times.

Appointment Scheduling

Automates booking process, managing calendars and setting reminders for upcoming appointments.

Payment, Refund Processing

Handles transactions smoothly, ensuring secure payments and processing refunds without hassle.

Order Tracking

Keeps customers informed by tracking orders from dispatch to delivery accurately.

AI-Powered Staffing Software

Streamlining the recruitment lifecycle with AI capabilities

Features

In-App Communication

Enables swift communication between job seekers, employers, and staffing agencies.

Payroll Management

Automates payroll, ensuring accurate, timely payments and reducing manual errors.

Integration With Enterprise Systems

Seamlessly integrates with CRM and accounting for efficient staffing operations.

White-Labeling for Brand Consistency

Customizable software for agencies to maintain brand consistency and professionalism.

Industrial IoT Software

Supporting most of the IoT sensors and actuators out there.

Features

Wireless

Access to all your IoT devices via centralized internet.

Detailed Reports

Generate PDF reports for sensor data and share them directly.

Notifications

Set limits so that you get quick alerts if something goes wrong or isn't as expected.

Data Analytics

Spot patterns and detect deviations in sensor data.

Headless E-Commerce Platform

Streamlining enterprise eCommerce with Biz4Commerce®

Features

Custom Integration

3D visuals and AR for product illustrations.

Customer Service

AI-powered

chatbots, CRM integration

Marketing Automation

Lead scoring, automated landing pages, cross-selling and up-selling.

International Commerce

Multi-language and currency support, taxes and payment.

Services

Resources

Blogs

Discover our handpicked collection of insightful blogs on latest industry trends.

Basic AI Chatbot Pricing: A simple chatbot that can answer questions about a product or service might cost around $10,000 to develop.

Read More

Biz4Group is a renowned software company that offers advanced IT solutions based on cutting-edge technologies such as IoT, AI, and blockchain. Their innovative and reliable approach has earned them a reputation as a leading global software company. Recently, Sanjeev Verma, the CEO and founder of Biz4Group, was interviewed by GoodFirms to shed more light on their business.

Read More

Chatbots are spreading their roots worldwide; every company wants to deploy or integrate them with their systems. But why is everyone running behind the integration and deployment of chatbots?

Read More

Music Streaming App Development Cost: A basic music streaming app mvp can cost somewhere around $20k – $30k, and a more advanced app with added functions costs somewhere around $50k – $60k.

Read More

Case Study

Transforming projects into excellence-driven, results-oriented transformation stories.

The story is about how we built an AI-powered avatar of our client that helped them train insurance agents with a 50% improvement in training efficiency.

Read More

Let's dive into the journey of how our team at Biz4Group developed one of its kind Avatar-based AI eLearning solutions for psychotherapy students.

Read More

The story is about how we built an AI-powered human resource management system that helped the ShiftFit staffing agency achieve 25% reduction in operational costs.

Read More

Adobe stands as a mogul today in the multimedia computer software industry worldwide. Adobe Flash, Photoshop, Adobe Illustrator, Acrobat Reader, PDF and Adobe Creative Cloud are some of the revolutionary creative solutions Adobe is currently offering to millions of users globally.

Read More

Company

AI Products

Services

Resources

We’ve helped insurance companies reduce operational efforts for claims processing by 73%. And we're ready to make your insurance operations efficient.

Schedule a MeetingTrusted by

We've built numerous insurance automation software to help our clients achieve success.

The insurance automation software we build are not one-size-fits-all; they are tailored for your specific operational processes.

From conceptualization and architecture designing, to development and AI integration, we are your one-stop-shop for AI insurance software solutions.

Our commitment to software excellence is echoed in the rave reviews from 100+ satisfied clients.

Insurance workflow automation, catering to your insurance operations, your workforce and customers alike.

Streamline claims handling with automated data extraction, case routing, and fraud detection powered by advanced AI.

Developing insurance workflow management system for improved accuracy in risk accessing and faster policy approvals for a better customer experience.

Enable flexible and market-agnostic insurance policies and prices by analyzing historical data and market trends.

Enhance fraud prevention by identifying suspicious patterns and anomalies in transactions with AI in real time.

Use generative AI to create centralized information systems and AI business assistants that assist your employees.

Enjoy hyper-personalization by offering AI-powered policies that suit your customer preferences and needs.

Implement next-gen customer support assistants that assist with queries, policy details, claim status, and more.

Use AI to simplify claim submission process that can guide customers through step-by-step process.

According to Accenture, 80% of insurance executives rank AI automation, chatbot assistants, and ML-based analytics as the top technologies for their business.

Talk to our expertsWe use cutting edge conversational AI in insurance to develop AI chatbots tailored for customers. These chatbots seamlessly integrate with your existing InsurTech ecosystem.

Our AI chatbot promptly addresses customer queries ensuring interaction with both prospects and customers at any hour.

From addressing queries to arranging interviews, the chatbot simplifies candidate interactions streamlining the recruitment process for an effective and user-friendly experience.

Customizable messaging options allow the chatbot to offer communication, enriching client relationships by providing updates addressing service inquiries and collecting feedback.

These projects are the testament of Biz4Group’s experience and expertise in building AI insurance automation solutions. From AI insurance agents to insurance workflow management system, we’ve built them all.

We developed an advanced AI chatbot, named George AI, for our client, a senior insurance leader responsible for training and assisting their team.

Instant AI-Powered Responses

Feedback-Driven Improvement

Powered by GPT-4o and GPT-3.5

Custom Training Functionality

Keep Records of User Interaction

Integration with Any Web Interface

PDF Consultant AI, developed by our team is a platform for document management. The application serves students, healthcare professionals, and other relevant audiences.

Summarize Content

Derives Insights from Text

Avatar-based Voice Search

Generate Research Ideas

Stores Data from Various Sources

An AI-powered Chatbot, specifically developed to improve customer service. It improves communication effectiveness by personalizing the support.

ChatGPT Integration

ML Model Training

AI-Powered Chatbot Editor

AI-Powered Tasks Training

Conversational AI

Organization Management

A platform built to assist therapy students in understanding psychotherapy case studies and assess their knowledge.

User login Google/ Gmail

Case study narratives

Centralized dashboard

Newsletter subscription

Payment and billing history

AI Avatars for learning assistance

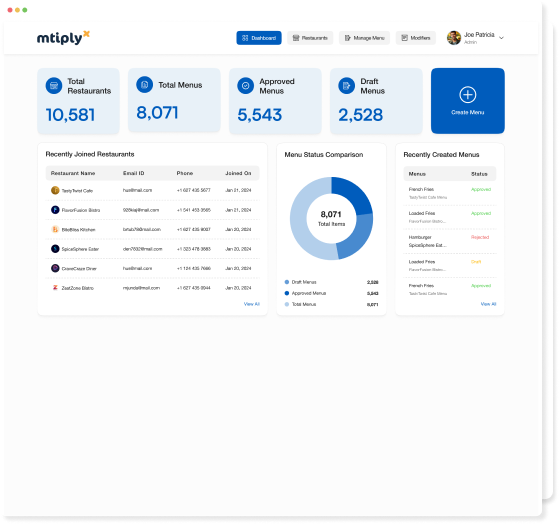

Mtiply, is an AI-based menu management system, built for virtual restaurants or cloud kitchen set up. Your menu is optimized as per what customers want to taste or what is running in the trend.

Virtual Kitchen Setup

Menu Item Generation with AI

Custom Modifiers for the Menu

Cloud Kitchen Promotion

Restaurant Onboarding, Promotion

Most Suitable Menu Suggestions

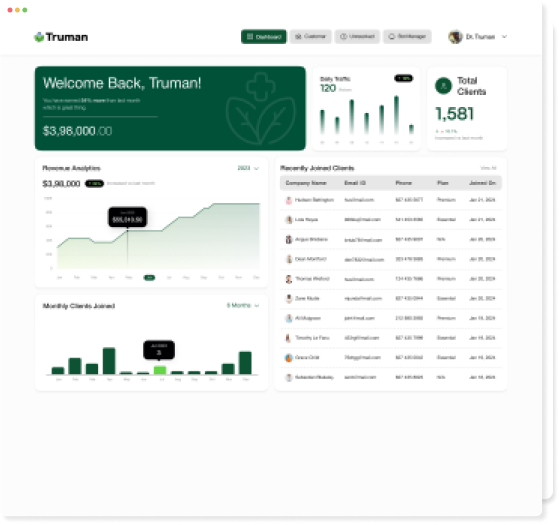

We upgraded the Herbal Health Review website into "Truman," an advanced AI-enabled web application, designed to offer personalized health advice and a seamless shopping experience.

AI Avatar of Dr. Truman

Generative AI Chatbot

Personalized Health Advice

Integrated Supplement Store

Health Record Management

Secure Payment Solutions

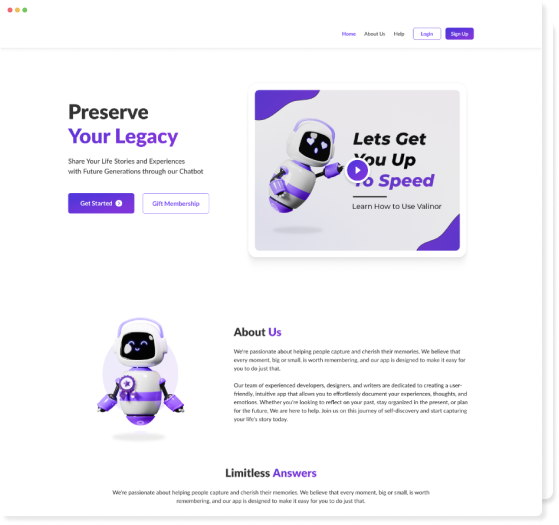

The chatbot stores users' life experiences and uses OpenAI to generate insightful follow-up questions, which their loved ones can explore.

AI Learns Via ML

Chat GPT-Based Integration

Audio-to-Text Conversion

Natural Language Processing

TTS Model for Text-to-Speech

Chatbot Access Over SMS

Train the AI

Conveyed in User Messages

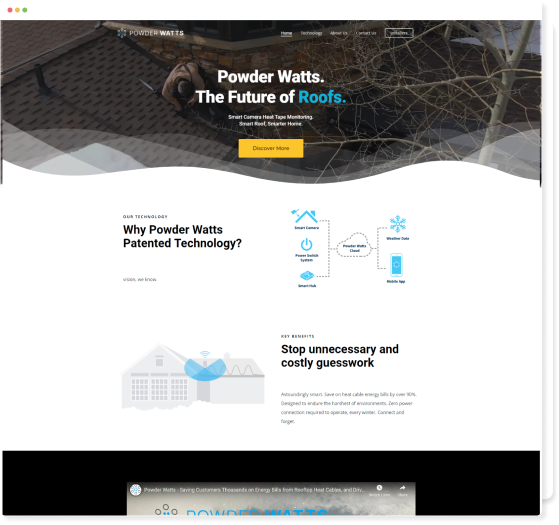

An AI-powered solution to prevent heat cables from ice and snow damage. It uses an AI-powered camera technology that saves power.

AI-Enabled Smart Cameras

Computer Vision

Huge Power Saving

Heat Cables Automation

In-Hand Control of Heating Cables

Alerts & Warnings

Judicious Power Consumption

VIDEO TESTIMONIALS

Founder & CEO, N2IT

My team is extremely excited about the product and the progress that we are making. We are very excited about moving into the next phase which is launch and then marketing. Thank you again for your continued work and your expertise at what you do. We just wanted to send our thanks and just keep up the good work. Have a good day.

Owner & Founder, Party Bands

Hello, I'm Candido Breto, founder and CEO of Party Bands LLC. At Party Bands, we proudly champion live performers by connecting clients with top tier bands for weddings, corporate events, private parties, and more. As a founder, it is my responsibility to ensure that our design is inviting, functional, and conversion focused. As we move into the development stage, I eagerly anticipate collaborating with Biz4Group's talented team of developers, and I'm confident that our journey will be both rewarding and inspiring.

CEO & Founder, Stratum 9

Biz4Group's project manager became an integral part of our team, going above and beyond by immersing herself in our project and even applying insights from our materials to the web application. We now feel like she is a true member of our team, which is rare. Biz4Group is doing an outstanding job, and we're excited to continue working together to make this project something special.

CEO, Udder Color

We're incredibly grateful for the time and effort Biz4Group has put into our website. The new site will be a key factor in our business growth and provide our clients with an unmatched experience. We’re excited for the next phase and appreciate all the hard work put into this project.

Founder

They take the time to actually sit down with us and understand what our goals are, and then putting that together in a plan to act to actualize. Biz4Group team is absolutely so professional, punctual, dependable. We definitely trust their feedback and expertise when moving forward with the setup of our product. We are absolutely recommending them for anyone who needs a developmental partner for their business.

Program Director at UNSHACKLED

I just wanted to thank you for reimagining, redoing our entire website which we have been needing to do for so many years. So, thank you. You’ve done a great job. You’ve designed it well. You’ve made it much more functional, friendly. It is much easier to navigate than it was before. It’s more optimized for mobile use. It was a process, but you held our hand the whole way.

CEO or Trainwell.AI

On time, regular support calls were helpful to know project status, everybody on the team is very organized, and they made Al simple for someone like me that is technically challenged. Will continue to work with them, convinced that there is no Al project that is out of their realm. highly recommend!

Marketing Head at 3CIoT

Utilizing AWS technology, the Biz4Group team delivered the project with minimal guidance, efficiently handling work across international borders and time zones. The application was completed on time and met high standards, significantly contributing to the launch of their successful online business.

CEO of NextLPC

Biz4Group's innovative approach has been transformative, introducing fresh, cutting-edge ideas that stand out in a competitive market. The team adeptly handles changes and challenges, maintaining quality and deadlines, and demonstrating remarkable adaptability.

CEO and Founder of AMxTD

Biz4Group's team excelled in communication, managing discussions across different time zones effortlessly and keeping me updated from the initial design phase to post-launch adjustments. Their approach made the entire process enjoyable and stress-free. They transformed my vision into reality with a high-quality, beautifully designed website that was delivered on time.

Family Office Director at Worth Advisors

This is Charles Withworth. I'm reaching out to express my deep gratitude for your dedicated efforts on Project 1A over the past six months. Looking back, we faced more complexities and challenges than anticipated, but your resilience and expertise have been crucial in navigating these. We are close to creating a world-class solution that will be a proud addition to your portfolios.

Python

Node.JS

React

Next.JS

Pytorch

Fastapi

Django

GPT 4

Gemini

Lalma

Advanced encryption standards

Transport Layer Security

Role-Based Access Control

API Security

Here is our step-by-step process of insurance automation software development. We ensure that in every step of this process, our client is involved – just to make sure that the project is a big success.

Our process begins with a dive into your requirements and underwriting goals ensuring that our AI solution aligns seamlessly with your company's risk management and policyholder objectives.

We carefully select reliable data sources to inform the AI model, establishing a strong foundation that is both robust and actuarially sound.

We create a roadmap centered around policyholders ensuring well defined goals and a strategic direction for implementing AI in underwriting and claims management.

Thoughtfully choosing the algorithms and predictive models for your AI solution customizing them to meet your underwriting and claims processing needs.

Developing a scalable and secure data architecture, supported by an infrastructure that addresses the intricacies of AI in insurance including compliance considerations and data privacy protocols.

Crafting user interfaces that're intuitive and engaging focusing on user friendliness to enhance the experiences of both agents and policyholders.

Creating a Proof of Concept or prototype to validate the effectiveness of AI for risk assessment and calculating premiums while gathering feedback for enhancements.

Collecting data with rigorous cleaning processes to ensure accuracy and quality, for training the AI. We work hard to train and adjust AI models, so they accurately represent insurance underwriting standards and market dynamics.

We bring together system components and conduct thorough testing to make sure everything works smoothly, complies with regulations and is reliable.

We create AI powered apps for easy access, on the move making it convenient for both agents and policyholders.

We keep an eye on metrics to assess and improve AI performance ensuring that the solution remains effective in underwriting and claims processing.

We regularly update algorithms and models based on data and changing requirements to keep the solution relevant and accurate.

By updating data sources and infrastructure to keep up with technologies and market trends, we ensure that our AI solution stays competitive in the insurance industry.

Custom AI solutions are providing real estate professionals with powerful tools that streamline operations, enhance customer experiences, and deliver insightful data analysis.

AI software automates routine tasks such as claims processing and underwriting, freeing up valuable time for employees to focus on more complex and strategic tasks. This is a core feature of any modern insurance workflow management system, making workflows more seamless and efficient.

AI-powered tools analyze vast amounts of data to assess risk more accurately, leading to better decision-making and more reliable pricing models. These capabilities are central to insurance AI automation, allowing insurers to make data-driven, timely decisions.

AI chatbots and virtual assistants provide instant support, leading to quicker response times and a more personalized experience for customers. This is an integral part of any automation solution for insurance, improving customer engagement and satisfaction.

AI systems can identify unusual patterns in claims data to detect fraudulent activities, improving the integrity of claims processing and reducing financial losses. This is a key benefit of insurance automation software, which helps prevent fraud more effectively than manual processes.

By automating processes and improving accuracy, AI reduces operational costs, helping insurance companies become more competitive in the marketplace. Insurance AI automation plays a significant role in driving these cost savings by streamlining repetitive tasks and improving overall efficiency.

Insurance automation software boosts underwriting precision by utilizing analysis in the insurance sector enabling precise risk evaluations through thorough data analytics in insurance. This leads to improved decision-making, decreased uncertainties, for insurers.

Certainly, AI solutions are crafted to integrate with existing legacy systems. With custom AI in insurance that aligns with your data framework and technology architecture, we ensure a smooth data transfer between applications.

The insurance automation software we build are meticulously developed with adherence to the regulations of the insurance industry. Whether it's automation of claims processing or AI driven risk assessment, all procedures are designed to comply with legal regulations.

Quality and comprehensive data is crucial for effective AI implementation. We make sure that all data utilized in the development of insurance software is handled securely adhering to protocols that safeguard privacy and maintain data integrity.

Absolutely AI solutions encompass claims processing automation as well as advanced fraud detection capabilities. By leveraging insurance data analysis, AI solutions help pinpoint patterns enhancing efficiency and minimizing losses during the claims process.

Our services has been recognized and acknowledged. See what some of the leading platforms thinks about us

Top 30 IoT Development Companies

Feel free to contact us whenever you want. Just tell us your query and we will revert back with a solution shortly.

Our website require some cookies to function properly. Read our privacy policy to know more.