Basic AI Chatbot Pricing: A simple chatbot that can answer questions about a product or service might cost around $10,000 to develop.

Read More

TL; DR

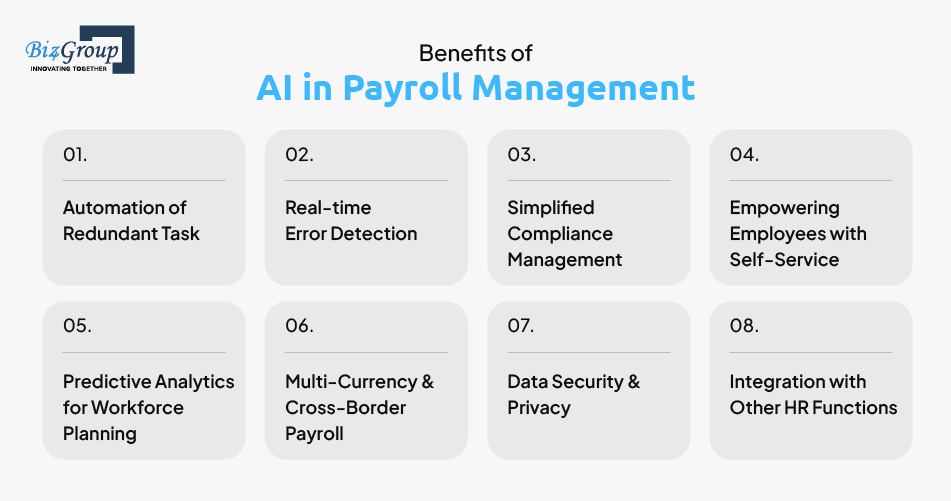

The role of AI in payroll management is meant to automate repetitive tasks, reduce errors, and enhance compliance.

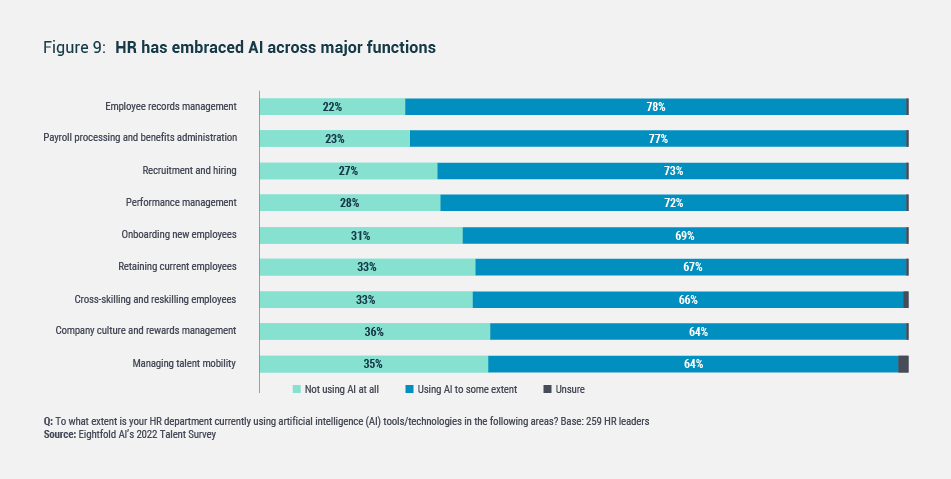

77% of 250 HRs surveyed, agreed to use AI in payroll processing.

The key benefits of leveraging AI in payroll include personalized employee experience, increased efficiency, and cost savings.

The challenges included in implementing AI in payroll processing include data security concerns, integration with legacy systems, and initial implementation costs.

Managing payroll includes meticulous calculations. It also includes adherence to tax regulations and timely disbursement of salaries. But, nowadays traditional payroll methodologies are not able to cope with the dynamic nature of modern workforce management. This as a result leads to errors.

So, to resolve this challenge, we are going to learn about the role of AI in payroll management.

AI is helping various industries to evolve, and so payroll management is no exception. Operations like automating repetitive tasks, detecting errors in real-time, and simplifying compliance management are seamlessly handled by AI intervention.

In fact, as per a report by Eightfold.ai, 77% of 250 HR surveyed, agreed to use AI in payroll processing. Additionally, there are other folds of HR operations as well where AI is already being used. The below illustration is a detailed explanation for the same.

Source: Eightfold.ai

Whether you are an HR professional or an entrepreneur, this guide will enlighten you on the holistic implementation and the challenges involved in leveraging AI in payroll management.

Traditional payroll systems depend on manual processes and outdated software. Therefore, from calculating wages and tax deductions to ensuring compliance with labor laws-all become very cumbersome tasks to accomplish, without any error.

To understand in detail the challenges involved in traditional payroll management systems, let’s delve into the depth of it:

Manual data entry may lead to miscalculation of taxes, and overlooked overtime payments which as a result may lead to employee dissatisfaction and potential legal concerns.

With changing labor regulations and tax codes, businesses operating across multiple states or countries find it difficult to stay compliant. This as a result increases the chances of fines and penalties. Here, traditional payroll systems fail to adapt to the changing compliance scenarios.

As an organizational resource, HR is not merely meant for performing redundant tasks like gathering employee data, verifying calculations, etc. They play a significant role in strategy formation too. However, under traditional payroll management, they are bound to be involved in performing repetitive tasks.

Traditional payroll systems lack robust cybersecurity measures. This leads to risk sensitive employee data like social security numbers, bank account details, and salary information.

The rise of remote work culture, gig economy workers, and flexible work schedules for workers has added complexity to traditional payroll management systems. The traditional payroll system cannot handle contractor payments, multi-currency transactions, and variable pay structures – altogether.

Therefore, such challenges lead us to unfold the benefits of AI in HR payroll operations.

One such benefit of AI in HR can be explored by taking this quick read on the Role of AI in remote staffing.

Here, we are going to learn how AI enables payroll systems to be more efficient and adaptive:

The role of AI for HR professionals, in automating tasks like data entry, payroll calculations, and tax deductions is impeccable. Such AI intervention brings more reliable payroll processing. For instance, AI can seamlessly handle payroll adjustments for overtime, bonuses, or deductions with precision.

AI’s advanced algorithms can detect anomalies in payroll data. Such anomalies can be duplicate entries or incorrect tax deductions. Hence, flagging these errors in real-time emphasizes the importance of AI in payroll management.

Machine learning models within payroll systems can adapt to new compliance requirements like local tax code changes or labor law revisions. Such an arrangement ensures that businesses remain compliant across various jurisdictions. Moreover, here AI can also minimize risks by creating audit-ready reports, required for regulatory submissions.

AI-driven HR chatbots prove to be a self-service resource for employees, in all terms, and not merely in payroll management. One of the AI-powered HR chatbot use cases is that it can be used as on-demand access to payroll information for employees. Such AI-driven chatbots can retrieve pay stubs, calculate overtime, and update tax forms, hence improving employee satisfaction

Interestingly, the predictive analytics model of AI can predict future labor costs by analyzing historical payroll data. Moreover, it can also predict overtime trends and workforce productivity. This as a result lets employers optimize staffing and budget allocation. Such insights indirectly indicate the importance of AI in staffing industry as well.

AI can handle multi-currency transactions and that too ensures compliance with local tax laws. It can even automate exchange rate adjustments, thereby generating accurate reports for international payroll operations.

AI’s ML algorithms can identify unusual patterns in payroll data like unauthorized access. It can trigger alerts to prevent potential security threats.

Modern AI payroll solutions are not difficult to integrate with the existing HR tools. Such AI payroll software creates a unified ecosystem for managing attendance, recruitment, and payroll.

Such an integrated payroll system can pull attendance records from an HRMS, calculate wages in real-time, and share automated payslips with employees.

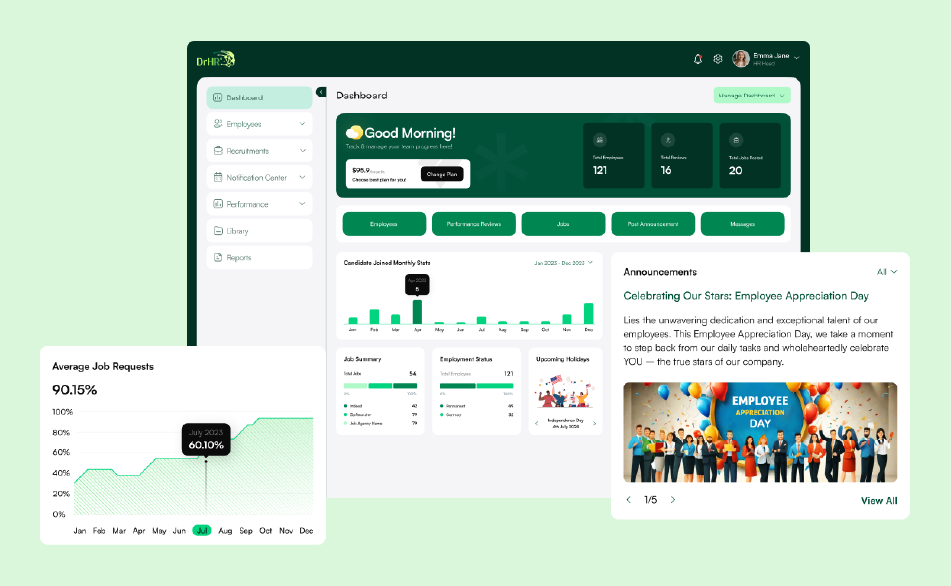

One such example of an HRMS tool is Dr HR. This AI-powered HRMS tool was developed by the expert team of Biz4Group wherein it was ensured that the tool can be seamlessly integrated with an AI-based payroll system, without hindering other recruitment and employee tracking functionality of the tool.

To learn more about how we built this HRMS tool, visit our Dr HR Portfolio.

You need to adopt a structured approach while transitioning from traditional payroll management to an AI-driven payroll management system. Below are the best practices to follow:

Identify pain points by conducting an audit of existing payroll workflows. This would highlight the type of inefficiency existing in the payroll process, i.e. manual processes, frequent errors, or compliance gaps.

Now is the time to define your requirements. Here, you need to determine what you aim to achieve with AI integration, whether it is reduced processing time, improved compliance, or enhanced employee experience.

Once you are sure about the problem you want to resolve, then comes the step to choose an AI system that aligns with your business size, payroll complexity, and geographic scope.

Moreover, in case you have reached this step and want to build a custom payroll management solution, you can visit AI integration services, offered by Biz4Group.

However, if you are looking for a SaaS-based AI-driven payroll software, then below is the next step for you.

Evaluate AI-powered payroll solutions like ADP, Gusto, or Paychex based on features, integration capabilities, and scalability. Check if whatever solution you choose fulfills:

Real-time compliance updates

Integration with existing HR systems

Encryption and anomaly detection.

Start with the small-scale implementation of an AI-based payroll system. You can start with a subset of employees to identify potential issues and gather feedback. Then, gradually roll out the solution across the organization in phases. Also, ensure that the employees are trained and receive adequate support at each step.

However, if you’re skeptical of the AI implementation disrupting your existing payroll workflow, you should contact an AI software development company like Biz4Group. We’ve worked with many organizations to implement AI without any disruption.

Once, your implementation plan is in place, it’s time to get your HR teams acquainted with the new system.

Address resistance to this transition by demonstrating the benefits of AI. Equip your employees with the knowledge to use AI tools, and perform data analysis and compliance monitoring.

To accomplish this, you can leverage AI chatbot integration in your payroll system to reduce payroll-related queries from employees to HR teams, hence allowing them to focus on strategic tasks.

Please demonstrate how the chatbot will work for HR teams. Maybe it can act like a helpdesk for HRs as well as employees seeking payroll-related assistance. Please write a paragraph for the demonstration.

Regularly assess the performance of your AI payroll system on various metrics. These metrics can be error reduction, processing time, and employee satisfaction. You can use feedback and analytics to continuously optimize payroll workflows.

Wonder what are the other ways AI can help in your HR process? Check this one out - Enhancing Employee Experience with Generative AI in HR.

Here are the potential challenges that you may face while implementing AI in payroll management:

When it comes to deploying AI-powered payroll systems, it comes with a significant upfront investment. Such investment includes software licensing, integration, and employee training costs. Here, small and medium-sized businesses may find it a costly initial expense.

Solution: You should start small and scale up later, depending on the optimal implementation of the AI-powered payroll system. Aim for long-term ROI by saving cost and efficient gains.

While you authorize AI to handle sensitive employee data which includes salaries, tax details, and bank account information, and that too without robust security measures, the data is then vulnerable to breaches.

Solution: To overcome this challenge, you can partner with an experienced HR software development company that has experience in building such solutions and can implement encryption, multi-factor authentication, and regular audits to secure your payroll data.

Organizations that are dependent on outdated payroll systems, can face difficulties in integrating the same with modern AI tools. Such compatibility issues may lead to data discrepancies during the transition.

Solution: Start the practice of system audit and prioritize AI solutions designed for seamless integration with legacy infrastructure.

AI systems depend on accurate and well-structured data for efficient performance. Whenever there is any inconsistency in payroll data, the effectiveness of AI algorithms is bound to be compromised.

Solution: Here, businesses should adopt the practice of data cleaning and standardization, before implementing AI tools.

As mentioned about employee training as a challenge, under the implementation cost above, AI has got you covered here too! Learn how AI can help you in training employees.

Payroll processes are set to be refined with advancing AI technologies in the future, thereby making the payroll process more predictive and employee-centric. To understand better, let’s have a look at the future trends that can shape the role of AI in payroll management:

AI is expected to bring end-to-end automation. It means that no human intervention would be required from handling data collection to compliance reporting. Such payroll systems would continuously learn and improve through ML algorithms, hence ensuring payroll accuracy and efficiency.

AI will offer deeper insights through advanced predictive analytics. This includes forecasting payroll costs, predicting employee turnover, increasing employee engagement, and optimizing workforce planning. Having such payroll features on board, businesses will be able to make data-driven decisions that would ultimately improve financial planning and resource allocation.

Blockchain-enabled payroll systems can automatically verify transactions. Such systems can also eliminate intermediary costs for international payroll operations. Moreover, blockchain technology when integrated with AI will enhance data security, reduce fraud, and ensure seamless cross-border payments.

Here, AI can recommend tax-saving options or create customized payment schedules, thereby providing personalization to employees. Hence, such personalization shows a crucial role of AI in employee engagement and satisfaction too.

After having a complete understanding of implementing AI in payroll management, in case you have decided to go for custom-based AI payroll software, you can check out Biz4Group’s more successfully implemented projects related to the HR industry below:

AI enhances the automation of data entry and calculations, thereby reducing human errors. It can detect inconsistencies and anomalies in real-time, hence ensuring precise payroll processing.

Implementing AI in payroll offers the following advantages:

Automation of repetitive tasks – It streamlines processes and decreases manual workload.

Improved compliance – AI keeps up with the regulatory changes and ensures adherence.

Cost savings – AI reduces administrative costs and minimizes errors.

Enhanced employee experience – It provides quick query resolution.

Yes, as AI-powered payroll systems prioritize data security. It can implement advanced encryption and continuous monitoring to protect sensitive employee information.

No, AI is only meant to augment human roles and not replace them. It can automate routine tasks, thereby allowing payroll professionals to focus on strategic activities. Irrespective of AI handling repetitive processes, human oversight is always necessary for decision-making under complex scenarios.

with Biz4Group today!

Our website require some cookies to function properly. Read our privacy policy to know more.