Basic AI Chatbot Pricing: A simple chatbot that can answer questions about a product or service might cost around $10,000 to develop.

Read More

TL; DR

Cost to Develop a Fintech App: Depends on complexity and AI integration: $20,000 to $300,000+ (or more).

Types of Fintech Apps: It includes the payment solutions, lending apps, robo advisers, personal finance management and insurtech. Depending on features, costs go up from $30,000 up to $500,000.

Key AI Features: Predictive analytics, fraud detection, development costs and AI driven wealth management solutions are changing a lot given the changes in AI powered chatbots.

MVP Approach: Viable Minimum Product (MVP) reduces the initial expenses, it helps fasten to the release, and also lets you validate some features.

Hidden Costs: The fintech app development cost also increases because of ongoing training of AI models, data updates, compliance to regulations ( GDPR, PCI DSS ).

Challenges: Development becomes complex and costly when it requires following financial regulations, complying with data security and integrating the new system with its legacy systems.

Development Timeline: Depending on complexity, simple apps take 3 to 6 months to build, more complex AI driven apps 12 to 18 months.

Biz4Group Advantage: Being an expert at AI-powered fintech apps, and providing end-to-end service from MVP development to compliance ensures they are the ideal partner for your project.

Fintech apps have transformed the financial sector in recent years and now it has simplified digital payments, lending, and financial management alike. Running today, and with artificial intelligence (AI) integral to the process, fintech apps are able to provide more personalized, faster, and safer services. AI integration is changing fintech apps in a number of different ways; from automating customer service with AI chatbots to using machine learning for fraud detection.

According to BCG, fintech revenues are projected to grow significantly, from $245 billion in 2021 to $1.5 trillion by 2030. The report highlights the rapid adoption of fintech apps, especially in the Asia-Pacific region, and covers the trends shaping the future of fintech globally, including the growing importance of customer experience and emerging regulatory challenges.

With demand for better user experiences, data driven insights, and better security measures through AI powered fintech apps on the rise for 2024, AI services that are targeted to fintech industry is on steady increase. But with this innovation comes the question: how much does it cost to build a fintech app with the use of AI?

This article will explain the development on a fintech app with the addition of AI technology at a cost. In this article we will look at the types of fintech apps, how the costs are affected and a few real-world examples to give you a better picture about how much fintech app development really costs.

| Type of Fintech Application | Cost Estimate Range | Key Features |

|---|---|---|

| Payment Solutions (e.g., PayPal, Google Pay) | $50,000 - $200,000 | Payment gateways, AI-powered fraud detection, user interfaces |

| Lending Apps (e.g., LendingClub, Prosper) | $100,000 - $300,000 | AI-driven loan approval, credit risk analysis, P2P lending |

| Investment and Robo-Advisors (e.g., Robinhood, Wealthfront) | $100,000 - $500,000 | Robo-advisors, AI-powered investment management, real-time data |

| Personal Finance Management (e.g., Mint, YNAB) | $30,000 - $150,000 | Budget tracking, AI-powered financial recommendations |

| Insurtech (e.g., Lemonade) | $100,000 - $300,000 | AI-powered claims processing, automated underwriting, fraud detection |

When determining how much does it cost to build a fintech app, the answer largely depends on the type of application and the level of AI integration involved. Next, we’ll take a look at the most common fintech applications, and associated costs to develop them.

There are so many popular payment apps like PayPal or Google Pay, mostly used for secure online payments. These apps leverage AI integration services to enhance payment security through AI-powered fraud detection and real-time transaction analysis.

To build a fintech app like this, it can cost anywhere from $50,000 to $200,000 depending on advanced AI features, payment gateways and user interfaces. Companies aiming to build similar apps can benefit from mobile app development services for both iOS app development and Android app development.

Companies like Lending Club and Prosper use AI for predictive analytics in the peer-to-peer lending business to automate loan approval and assess borrower’s creditworthiness. These AI powered solutions reduce manual error in the lending process.

So, for lending apps, how much does it cost to build a fintech app like this.

The cost to build a fintech app like this is between $100,000 to $300,000. Businesses can hire AI Development services to ensure seamless integration of machine learning models. Lending platforms are also feasible for additional leveraging AI consulting services to optimize.

Investment apps such as Robinhood or Wealthfront rely heavily on AI-powered wealth management software. The AI in fintech applications deliver personalized investment advice through the ‘robo advisors,’ who manage user portfolios.

Due to the complexity of AI algorithms and the need for real-time data processing, the cost to develop fintech apps with investment features can range from $100,000 to $500,000. For businesses seeking to implement these solutions, hiring a Enterprise AI Solutions provider is crucial.

Mint and other similar apps like it help users manage their budgets, save and track their spending. AI automation in insurance and financial planning helps create personalized recommendations and alerts for users. Typically costs around $30,000 to $150,000 if your features include personalized financial insights and AI powered chatbots.

Utilizing Custom Chatbot Development services can enhance user interaction by automating customer support.

Insurance automation software is transforming how insurance companies handle claims and underwriting. Places like Lemonade are using AI development platforms to process insurance claims faster and also to assess the risks more efficiently.

The development of an AI powered app for insurance can cost from $100,000 to $300,000 or more depending on the sophistication of the deployed AI models. Companies can also consider using innovative AI case studies to refine their app development strategy.

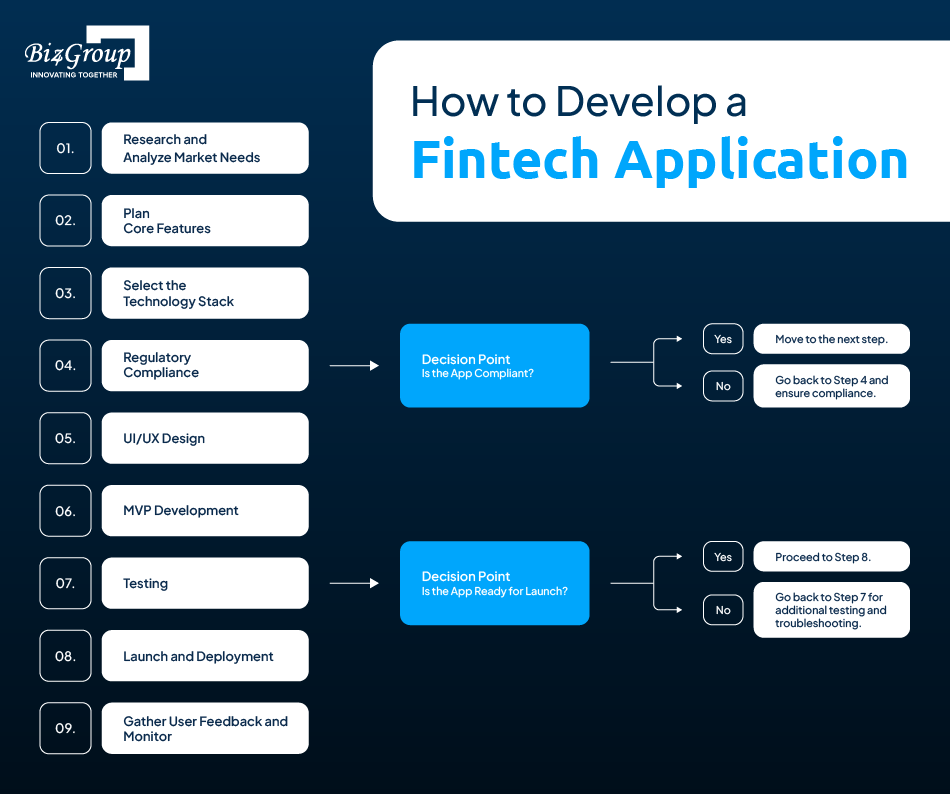

Understanding how to build a fintech app requires a well-planned strategy that aligns user needs with regulatory compliance and integrates advanced technology like AI, before you grasp a clear understanding on how much does it cost to build a fintech app. Below are the essential steps involved in fintech app development.

The first step in how to build a fintech app is identifying your target users and the specific financial problem your app will solve. This might be personal finance management, lending, or whatever, but having a clear focus allows you to structure the product around the most important part first — the features and user experience.

When determining how much does it cost to build a fintech app, the core features play a significant role. Standard functionalities like payment gateways, secure login, and AI-powered chatbots should be prioritized. Advanced features, such as AI-powered wealth management software, can be added later to scale the app’s capabilities.

Choosing the right technology stack directly impacts the answer to this question as how much does it cost to build a fintech app, i.e the cost to build a fintech app, altogether. A robust backend, secure APIs and quicker integration with AI development platforms are what you will need. For cross-platform compatibility, hybrid app development services are often a more affordable and time-efficient solution.

To build a compliant fintech app, it’s essential to comply with regulations such as GDPR, PCI-DSS, and PSD2. Disregarding these would not only hypothetically stack legal costs, but also undermine user trust. Collaborating with AI Consulting Services can help incorporate features like insurance automation software while ensuring compliance.

MVP is a smart way to cut first costs the least way possible. Launching quickly with the essential features and collecting user feedback and then polishing your app based on real data — that is what MVP helps you to do. This can significantly reduce the initial fintech app development cost. The mvp prototype cost typically ranges from $30,000 to $100,000, depending on the app's complexity.

Ideally, testing your app should strictly be a critical process to launch it. Testing for security risks, performance problems, and user experience to ensure that the app will run smoothly. As early as the launch, an app will still need to operate as functional and secure, necessitating ongoing updates after that as well.

To answer your question as how much does it cost to build a fintech app, appropriately, we need to understand that it very much depends on the complexity, features, and technologies involved in building the fintech app. There are various factors that affect the fintech app development cost. Some of which include AI integration, app platform, and regulatory compliance.

In case you are planning to build a simple application with core features, the basic cost to build a fintech app starts at around $20,000. Besides, if you further plan to add advanced AI functionalities such as custom chatbot development or AI-powered wealth management software, the same cost can rise to $300,000, and even more.

Additionally, the price also increases in case you choose to go for hybrid app development services or native apps or the number of platforms like iOS and Android.

The fintech app development cost also enhances due to adding AI capabilities like predictive analytics, machine learning, or AI-powered chatbots for customer service. Moreover, in case you opt for integrating these services from companies like generative AI development company or using AI consulting services, the expense is increased by 20-40%.

Additionally, businesses that are looking for AI automation in insurance or AI in fintech solutions, need to spend extra costs for model training and maintenance.

Traditional fintech apps without AI, cost less. But adding AI development platforms and using AI-powered wealth management software takes more time and money to develop. Companies should team up with AI Integration Services and Enterprise AI Solutions providers to make sure everything goes smoothly, when putting these systems into action.

When we talk about creating fintech apps that use AI, we face several hurdles that can affect how much does it cost to build a fintech app. To make sure the app succeeds in the market, we need to understand and tackle these challenges.

A big hurdle in how to build a fintech app is making sure it follows all the rules. These apps need to stick to tough money standards like GDPR, PCI-DSS, and PSD2. If they don't, they could face fines and legal trouble, which increases the fintech app development cost. Working with AI Consulting Services can help add compliance solutions, in the development stage only.

When fintech apps handle sensitive user data, ensuring top-notch security becomes essential. AI has a significant impact on spotting fraudulent activities and securing transactions as they happen.

But using these AI-driven solutions makes things more complex and expensive from a technical standpoint. Companies often need help from AI development platforms or Enterprise AI Solutions to create secure fintech apps.

Merging cutting-edge fintech apps with old-school financial systems can be tricky and slow. Many big banks and money firms still use outdated systems that don't play nice with AI features. This means spending more cash to make apps work and upgrade systems. AI Integration Services make this job easier helping new tech work with old systems.

AI-powered fintech apps need lots of data to train their models. This ongoing job of feeding data into AI models to make accurate predictions can drive up the cost to build fintech app. Also, these models need constant upkeep and updates to stay in step with changing financial trends. Working with a generative AI development company provider can help handle these issues.

The time to build a fintech app depends on several things such as how complex the app is, what features it needs, and if it uses AI. If you're asking yourself about how much does it cost to build a fintech app, you should also think about how long it will take, as apps that take more time to make cost more.

Creating a simple fintech app with core functions like user login, payment systems, and basic money tracking can take about 3 to 6 months. These apps don't have advanced AI features, which helps keep the cost of developing a fintech app down. Companies often choose hybrid app development for these kinds of apps to release versions for both iOS and Android platforms.

Creating a more sophisticated fintech app with AI-based features, like AI-powered wealth management software, custom chatbot development, or insurance automation software, can take 12 to 18 months. These apps need more time to develop because they require AI model training thorough testing, and adherence to regulatory standards. This longer timeline has an impact on both the cost to build fintech app and how long the entire project lasts.

Feature Complexity: More advanced features like AI-powered chatbots, fraud detection systems, and predictive tools increase development time. Working with seasoned AI consulting services can speed up the integration of these technologies.

Regulatory Compliance: Making sure the app follows rules like GDPR and PCI-DSS can also slow down development, as checking compliance and testing security are essential.

Platform Choice: Building apps for multiple platforms (iOS and Android) can stretch timelines if native development is needed. Using hybrid app development services can quicken delivery while reducing costs.

If you choose to roll out a Minimum Viable Product (MVP) first, you'll spend way less time on development. You can finish an MVP with key features in 2 to 3 months, giving you a chance to get feedback before you add more complex stuff. This way, you can cut down on your initial mvp prototype cost and get to the market faster.

Creating a Minimum Viable Product (MVP) plays a key role when you build a fintech app using AI. It lets you launch fast with key features, get user feedback, and make the product better over time. This method helps control how much does it cost to build a fintech app, i.e. cost to develop a fintech app and cuts down the risks tied to a full-scale launch.

When figuring out how much it costs to develop a fintech app choosing the main features for the MVP plays a big role. Picking the most important features helps keep the initial cost to build fintech app down and keeps the development focused. Here's a list of key features you should include in the MVP:

AI-Powered Chatbots: Chatbots offer support to customers in real time, which makes the user experience better and cuts down on the need for humans to step in. When you add custom chatbot development to your MVP, it can boost how much customers interact with your app.

Predictive Analytics: AI-driven predictive analytics help fintech apps guess what users might do next. This leads to personal money advice and better handling of risks. If you put this feature in your MVP, your app becomes more valuable.

Fraud Detection: AI-based systems to spot fraud are key for fintech apps. They keep transactions safe and guard against possible threats. When you build in these safety features on, users start to trust your app more.

By zeroing in on these essential AI capabilities, you can keep the MVP prototype cost in check while still delivering a robust product that satisfies user requirements.

A lean strategy in MVP development puts emphasis on cutting waste homing in on core functions, and expanding features step by step based on user input. This approach allows you to keep the fintech app development cost low at the start. By embracing lean methods, companies can launch the MVP and introduce more advanced AI features—such as AI-powered wealth management software or AI automation in insurance—in future updates.

When building a fintech app with AI and answering the question as how much does it cost to build a fintech app, the Minimum Viable Product (MVP) approach makes a big difference. An MVP is a version of a product that has just enough features to keep early users happy and get their thoughts on how to make the product better.

For fintech and AI, it lets companies test key AI features—like chatbots predictive analytics, or fraud detection—before making the app bigger. This smart way of developing helps manages the cost of making a fintech app while still bringing in new ideas powered by AI.

An MVP in fintech means launching the basic version of your app that still gives users value. This approach centers on core functions needed to address the main user issue, like AI-powered customer help or simple transaction handling.

By starting with a few features, businesses can enter the market fast, get real-world user input, and improve AI models based on this feedback. In a fintech app, the MVP might have basic AI-powered chatbots or AI-driven risk assessment tools that offer quick value but leave space to grow.

Developing an MVP has a main advantage: it saves money. When you focus on must-have features, you can keep how much does it cost to build a fintech app low at first i.e. cost to develop a fintech app. This lean method stops you from wasting money on features users might not want.

You can add more features step by step as your app grows helping you manage your budget better over time.

Using AI integration services or AI development platforms can make the development more efficient while keeping your starting costs under control.

An MVP lets businesses launch beating competitors to the punch. In fintech where users' experience matters most, getting to market plays a key role in success. By putting out an MVP, you can deliver a working version of your AI-powered fintech app in just a few months.

At the same time, you can keep improving advanced AI features like AI-powered wealth management software or AI automation in insurance based on data from users.

Developing an MVP has another big plus - it lets you test and check important AI features. With an MVP, fintech companies can watch how people use AI parts like predictive analytics or automated financial advisors.

They can then make changes on the spot, based on what they see. This step-by-step process helps make sure the final product is easy to use and works well cutting down on the risks of building a full app right away.

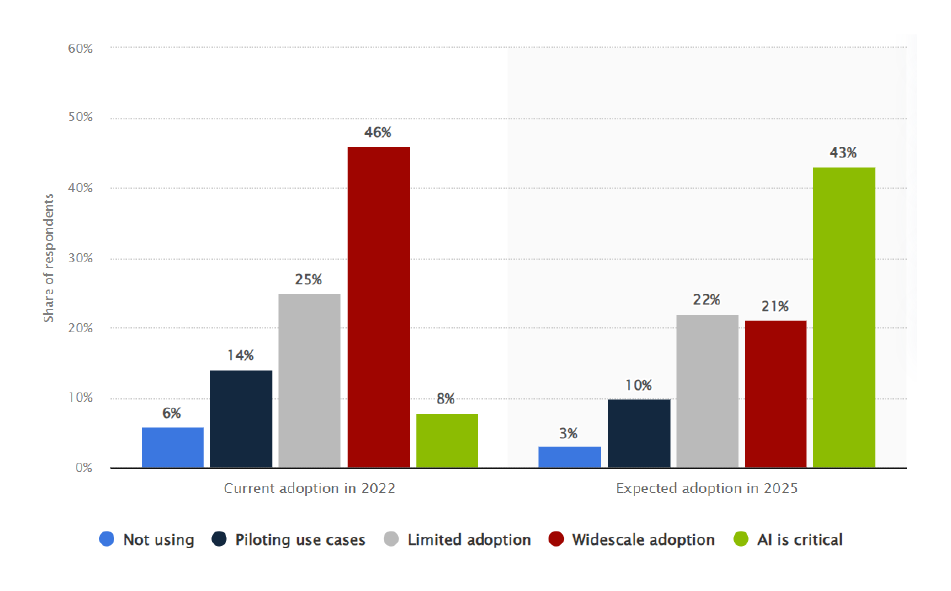

AI has changed financial technology by introducing advanced solutions such as fraud detection, forecasting and customer service and, while it’s fantastic at filling the gaps created by the AI revolution in the financial industry, it also comes with hidden costs that, over time, can add up.

Artificial intelligence (AI) adoption rate in financial businesses worldwide in 2022 and 2025

Source - Statista

These costs often extend beyond the initial development phase, contributing to the overall concept of how much does it cost to build a fintech app, i.e cost to develop a fintech app. Understanding these hidden costs is vital to ensure accurate budgeting for AI-powered fintech applications.

Continuous training and maintenance of AI models is a huge hidden cost in the development of AI driven fintech. When AI models are implemented to wealth management AI solutions or insurance automation software, they need to be always updated as AI models are imperfect.

In predatory areas like fraud detection & risk analysis, these models require the ability to learn from new data to keep accuracy. Regular maintenance involves ongoing data acquisition, model updates, and the involvement of AI development platforms for performance optimization.

For instance, the use of AI automation in insurance will involve maintaining AI models that assess claims data or ultimately risk, which will result in higher long-term costs.

Additionally, the post-launch costs related to employing Enterprise AI Chatbot Development teams for upgrades or troubleshooting issues add to the maintenance expenses. Regular updates are crucial, especially when working with complex fintech software solutions that handle evolving financial data.

If you’re ready to build a fintech app with AI as your power source, you need to select the right partner. Over their years of experience and innovative approach, Biz4Group is a leader in providing fintech solutions using the most advanced AI. Here's why Biz4Group can be the right choice for your project:

As an AI automation professional, Biz4Group provides solutions in the domain of insurance, wealth management AI solution and custom fintech software solutions for modern financial services.

If you require AI powered wealth management software or a more advanced fraud detection solution — we have you covered with completely custom solutions based on your business needs. However, their team of experts allows businesses to integrate AI consulting services with ease, giving them confidence to innovate.

Biz4Group offers from the initial planning process to the post launch support services. They enable you to build a compliant, secure and scalable fintech app without burning through heavy costs.

When it comes to Enterprise, their extensive knowledge in Enterprise AI Chatbot Development and computer vision development, guarantee you that your app meets the highest standard of security and performance.

Built on a proven track record of doing successful projects with all industries, like finance, Biz4Group is geared to assist you in maximizing your business’s productivity and efficiency.

The first solution from their portfolio includes inventive AI driven solutions to fintech with analytics in real time, including personalized financial management, that provide some benefits. This means they are a trusted partner for any fintech project due to their skills and expertise with AI integration services and AI development platforms.

One of the primary concerns when asking how much does it cost to build a fintech app is managing costs effectively. By using the lean MVP app development approach, Biz4Group helps businesses launch faster, and at the same time reduce the initial cost of fintech app development.

Their solutions are scalable in that they scale with your business, so your business succeeds in the long term.

with Biz4Group today!

Our website require some cookies to function properly. Read our privacy policy to know more.