Basic AI Chatbot Pricing: A simple chatbot that can answer questions about a product or service might cost around $10,000 to develop.

Read More

TL; DR

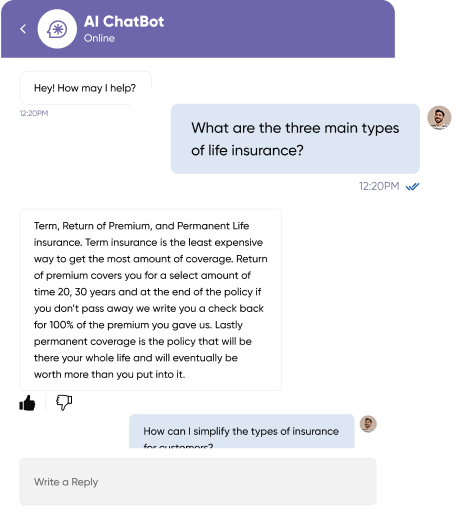

AI chatbots automates insurance training by addressing common queries sales agents have. They accelerate agent training and knowledge retention.

89% of insurance firms are planning to invest in Generative AI by 2025.

Automated compliance training – Reduces regulatory errors and keeps agents updated in real time.

AI-driven sales coaching – Helps agents handle objections and close deals more effectively.

Conversational AI for insurance – Delivers interactive, real-world training simulations.

Adopt MVP-first approach – Build a testable AI chatbot before full deployment to maximize ROI.

As a training manager or, maybe a chief learning officer, you might struggle training the sales representatives as product offerings and compliances keep changing.

No wonder your agents are burdened with static, one-size-fits-all training modules, leading to long onboarding times and unreliable performance.

However, your industry is already taking action to solve these problems!

89% of insurance respondents like you, are planning to adopt generative AI wherein

76% of them are adopting it for operational cost reduction,

72% for compliance improvement and,

81% for customer retention.

At Biz4Group, we’ve successfully developed an AI chatbot for insurance. It helps agents quickly adapt to changing policies and customer needs. This guide will walk you through the steps to create an AI chatbot for insurance sales onboarding process, and the related case studies.

Guide Tip:

While reading this guide, keep your challenges in mind. i.e. "What are your agents’ biggest training struggles? Are they disengaged with static training material, or is your onboarding process taking too long?”

Build your custom AI chatbot for insurance sales onboarding today.

Schedule a CallImagine this: Your new agent, Sarah, starts her onboarding journey with high enthusiasm. But, she's soon bogged down by lengthy manuals, static training modules, and hours of in-person lectures.

By the time she's ready to handle customer calls, regulatory updates have already rendered some of the training obsolete. She feels unprepared and frustrated.

This is the reality of traditional insurance training systems—slow, rigid, and ineffective in today’s dynamic industry. Trainers must manually update materials to stay compliant with regulations, and agents are left with limited opportunities to practice real-world scenarios.

The result? Low knowledge retention, compliance risks, and long onboarding timelines.

Now, imagine a different experience:

Sarah begins her training with an AI-powered insurance assistant that guides her through interactive modules, designed specifically for her role. The chatbot simulates real customer scenarios, dynamically adapts training content based on her progress, and automates compliance updates in real-time.

She’s fully onboard and confident in half the time it took before!

This isn’t just a vision— 76% of insurance firms are prioritizing reduction in operational cost through AI, and 72% are using it to enhance compliance measures.

Source: X.com

The answer to the challenges we've discussed so far is opting for insurance sales onboarding chatbot development.

Now, let’s explore the benefits of developing the Gen AI-based insurance training chatbot, along with real-world case-studies of reputed insurance firms who’ve adopted it for simplifying agents onboarding:

AI chatbots not only provide personalized training but also streamline repetitive administrative tasks. Such redundant tasks can be compliance verification, and policy explanations.

For example, Gen-AI chatbots can simulate real-world customer interactions. Here, trainees get to handle queries in a risk-free environment, thereby accelerating learning curves.

Hence, they enable agents to focus on strategic decision-making and make the entire onboarding process faster.

Implementing AI chatbots in insurance sales onboarding can lead to reductions in operational costs and time expenditures. They can automate routine tasks and optimize customer interactions.

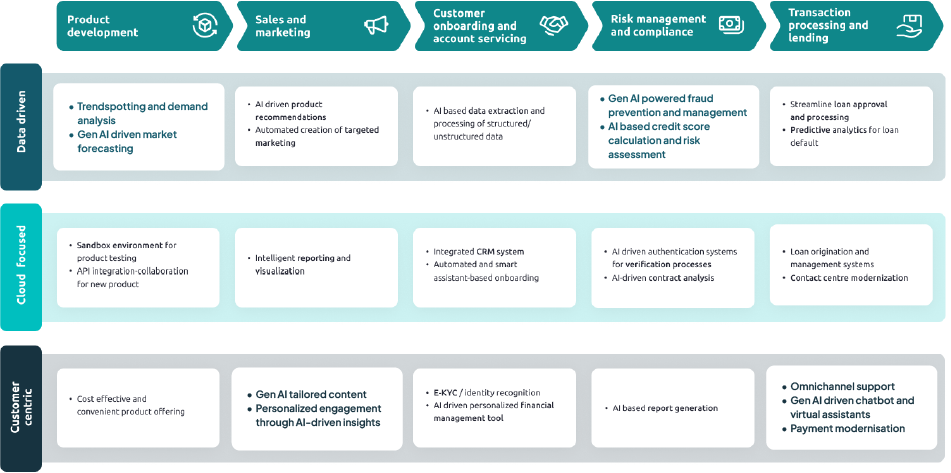

For a comprehensive understanding, see in the illustration how Gen-AI can ease out an entire insurance sales onboarding process. However, it has an indirect role to play but the results achieved are significant:

Source - Capegimini

Instead of scheduling separate compliance testing sessions, AI chatbots administer quizzes on-the-fly, track progress, and auto-certify agents once they meet training criteria. This removes bottlenecks in onboarding.

All we've talked about isn't just science-fiction. In fact, recently, an insurance company used AI onboarding process.

Generali implemented expert.ai’s platform to automate the reading and sorting of over one million emails annually. The system automatically processes emails and attached documents in real-time, redirecting them to the appropriate departments.

This automation has increased staff efficiency by eliminating repetitive tasks, enabling trainers and agents to concentrate on higher-value activities like personalized onboarding and customer engagement.

This case demonstrates how AI automation in insurance can reduce time spent on routine tasks, freeing up resources to accelerate sales onboarding and improve agent productivity.

Here, you’re going to learn the step-by-step process for insurance chatbot development. In fact, while building an insurance sales training chatbot for one of our clients, we used the same process to bring the client's vision to reality:

Ask yourself:

Are your agents struggling with onboarding and compliance training?

Are your agents struggling with understanding complex policy structures?

Start by identifying your biggest training bottleneck. That’s the first step toward building an AI-driven solution.

For more reference, here is a checklist of training needs that your agents might require. These points would help you to explain about the goal to the development company for building an AI chatbot.

Let’s understand ‘defining the vision process’ with the help of Biz4Group as an example:

When we first sat down with the client—a mid-scale insurance provider—we noticed something alarming. His agent onboarding process was painfully slow. New agents had to sift through hundreds of training materials, rely on manual compliance updates, and worst of all, wait weeks before they were confident enough to handle real customers.

The Challenge?

It took 6+ weeks to onboard new agents.

Agents weren’t retaining policy details effectively.

Compliance training updates were manual and time-consuming.

“We needed to change the game for them,” said one of Biz4Group’s AI architects. "Why not build an AI-powered insurance assistant that could train agents interactively, answer questions in real-time, and even run compliance checks instantly?"

Here is a list of some prominent and advanced features that you may consider for your chatbot:

AI-Powered Knowledge Base

Instant access to policy, claims, and compliance information so agents can get real-time answers without searching through manuals.

Interactive Scenario-Based Training

Simulates real-world customer interactions to help agents practice sales conversations and policy explanations.

Compliance Training & Automated Regulatory Updates

Alerts agents about state-mandated disclosure requirements so that they do not miss informing their clients, about such compliance updates.

AI-Driven Role-Playing & Sales Coaching

Guides agents through simulated objections and upselling techniques to improve sales performance.

Real-Time Performance Analytics & Reporting

Monitors agent progress, engagement, and accuracy to identify areas needing improvement.

Conversational AI for Adaptive Learning

Personalizes training paths based on agent performance to focus on their weak areas.

Multilingual & Omnichannel Support

Supports multiple languages and integrates with CRM, email, and messaging platforms for a seamless experience.

AI Chat Interface for Sales Conversions

Provides real-time suggestions for policy comparisons and closing strategies during live sales calls.

Automated Compliance Audits & Knowledge Retention Tests

Ensures agents retain knowledge with periodic quizzes and tracks compliance adherence.

Integration with CRM & Learning Management Systems (LMS)

Syncs AI chatbot data with existing training platforms to provide a unified learning experience.

Here’s how we dealt in designing the chatbot’s core features:

Once the pain points were clear, with the help of client’s subject-matter expertise and our team’s research, we could map out the AI chatbot’s core capabilities. The goal? Make onboarding faster, compliance easier, and training more engaging.

What We Built:

Adaptive Learning Paths – The AI chatbot would personalize training for each agent.

Instant Query Resolution – Agents could ask policy-related questions and get answers instantly.

Compliance Training on Autopilot – AI updates training modules whenever a new regulation is introduced.

One of the biggest breakthroughs came when the chatbot was tested with real agents. They no longer had to wait for a human trainer to clarify policy questions—the chatbot could instantly fetch information, just like a Google Assistant for insurance training!

Why Start with an MVP?

An MVP (Minimum Viable Product) is the first version of your AI chatbot that includes only the essential features, needed to test its effectiveness before full deployment.

Reduces risk – You can validate AI’s impact before committing to full-scale development.

Optimizes budget – Focuses only on high-impact features to maximize ROI.

Improves adoption – Helps insurance agents get comfortable using AI before expansion.

📥 AI Chatbot MVP Development Guide for Insurance Sales Onboarding

Start Small. Scale Smart. Validate AI for Insurance Training the Right Way!

🛠 Must-Have Features in Your AI Chatbot MVP

AI-Powered Knowledge Base

✔ Provides instant responses to agent training questions.

✔ Pulls information from verified insurance documents, policies, and compliance materials.

Interactive Scenario-Based Training

✔ Simulates real-world customer interactions to help agents practice.

✔ AI adapts training based on agent learning progress.

Compliance Training Automation

✔ Sends real-time alerts about regulation updates.

✔ Auto-generates compliance quizzes to track agent understanding.

AI-Driven Role-Playing & Sales Coaching

✔ AI chatbot acts as a virtual customer, evaluating agent responses.

✔ Provides instant feedback to refine sales techniques.

Basic CRM & LMS Integration

✔ Syncs with existing CRM & Learning Management Systems (LMS).

✔ Allows AI to track agent progress and personalize training modules.

📊 How to Test Your MVP Before Full Deployment

✅ Pilot with 50-100 Agents – Start small and collect performance data.

✅ Track AI Accuracy – Compare chatbot responses with human trainers.

✅ Measure Training Time Savings – Check if onboarding speed improves.

✅ Analyze Compliance Improvements – Ensure AI helps reduce errors.

✅ Collect Agent Feedback – Gather insights to refine chatbot responses.

🔹 Pro Tip: A strong MVP should deliver at least 20% faster onboarding—if it does, it’s ready for expansion!

⏳ MVP Timeline – How Long Does It Take?

📌 Week 1-2: Define chatbot objectives & scope.

📌 Week 3-6: Build core AI chatbot features.

📌 Week 7-8: Conduct pilot testing & refine AI responses.

📌 Week 9+: Scale AI chatbot to the full organization.

Don’t try to build everything at once. Focus on solving the biggest training pain points first!

🎯 MVP is Just the First Step!

Starting with an MVP ensures smarter AI adoption, reduces risks, and creates a scalable AI training system for your insurance agents.

📌 What’s Next?

✔ Expand AI to sales coaching & customer interactions.

✔ Optimize chatbot responses using real-time performance data.

✔ Integrate AI-driven insights to continuously improve agent efficiency.

Here is how we built MVP for insurance AI chatbot:

After finalizing the features, Biz4Group didn’t go all in on a fully-fledged chatbot. Instead, they built an MVP (Minimum Viable Product) first—a smaller, testable version of the chatbot with just the essential features.

The MVP focused on:

AI-powered role-based training for new agents.

A chatbot interface that guides agents through real customer interactions.

A knowledge base that is automatically updated with compliance changes.

The First Real Test:

The chatbot was tested on a small group of new agents.

Biz4Group monitored how quickly agents completed training.

They analyzed how well agents retained knowledge compared to those trained manually.

The result? Agents trained with AI completed onboarding 70% faster than those trained traditionally!

After learning everything on how to build an MVP, you may want to know how much does it cost to build an MVP. Give it a read.

Select a Representative Agent Group for Testing

Choose 50-100 agents across different experience levels, departments, and locations to ensure diverse feedback.

Define Key Success Metrics

Set clear KPIs such as agent engagement, response accuracy, training time reduction, and chatbot usability ratings.

Monitor AI Response Accuracy & Knowledge Retention

Track whether the chatbot delivers correct answers, explains policies effectively, and improves agent learning retention.

Gather Real-Time Agent Feedback

Use surveys, feedback forms, and live chat monitoring to collect insights on chatbot usability, accuracy, and areas for improvement.

Refine AI Responses & Optimize NLP Models

Adjust chatbot responses based on agent queries, frequently asked questions, and misinterpretations.

With an MVP showing promising results, Biz4Group rolled out a pilot test across multiple teams. This wasn’t just about testing the chatbot—it was about seeing how agents interacted with AI in real-world training scenarios.

What We Learned During Pilot Testing:

AI-assisted agents asked 40% fewer repetitive questions—because they were getting instant answers.

Compliance updates no longer caused delays. The chatbot sent real-time alerts whenever regulations changed.

Agents felt more confident handling customers after just 3 weeks of training.

An agent from the pilot test shared her experience:

"I used to feel lost in all the policy details, but now the chatbot walks me through real scenarios. It’s like having a personal mentor available 24/7!"

A chatbot isn’t just a tool—it’s a learning companion. Make sure it feels natural for agents to use!

Plan an internal launch event for your chatbot.

Create training resources so agents know how to make the most of it.

Here’s how we went about full deploying the insurance AI chatbot:

After testing and refining, Biz4Group deployed the chatbot company-wide. But launching an AI chatbot isn’t just about making it live—it’s about making agents comfortable using it.

How We Ensured Successful Adoption:

Created AI onboarding guides to help agents learn the chatbot’s capabilities.

Ran live training sessions to show how the AI chatbot could assist in daily tasks.

Integrated chatbot analytics to monitor agent performance and engagement.

You can check out the demo video of our deployed insurance AI chatbot here:

After launch, think long-term. How else can AI support your agents? You can also consider the points below to seek a better idea:

AI-Powered Sales Coaching & Lead Scoring

Analyzes agent interactions and recommends real-time coaching tips. This in turn improves policy presentations & helps them in closing more deals.

Detects Fraud & Risk

Here, AI can be used to identify high-risk customers. It can also flag fraudulent claims using data analysis.

Continuous Learning & Personalized Career Growth

Tracks agent performance and suggests tailored training modules. This as a result enhances sales skills and product knowledge in the agents.

After a few months, Biz4Group started expanding the chatbot’s role:

AI Upgrades After Deployment:

AI-Driven Sales Coaching – The chatbot now helps agents handle objections better.

Voice AI Features – Agents can practice verbal pitches with AI simulations.

Advanced Analytics – The system tracks agent performance and suggests training improvements.

Here you can explore our complete portfolio on Insurance AI.

At Biz4Group, a generative AI development company, we don’t just develop AI solutions—we create intelligent, results-driven chatbots that transform agent training, sales enablement, and compliance processes.

What’s Next?

The potential of AI in insurance doesn’t stop at onboarding—it extends to lead generation, customer service, and real-time sales coaching. If you’re ready to leverage AI for better agent performance and business growth, now is the time to take action.

Moreover, if you wish to extend automation in various processes other than onboarding, you can check out our explicit service on insurance automation software development.

To learn more about our chatbot development services, explore - AI chatbot development services

The key benefits of implementing a Gen-AI chatbot in insurance agent training are as follows:

Shortens onboarding time

Delivers real-time compliance updates, without any requirement for manual training sessions

Simulation of real-world customer objections to improve agent confidence

Tracks agent performance & suggests learning paths.

Example: Instead of waiting for a manager to explain policy changes, an agent can ask the chatbot and get an instant answer.

No. AI chatbots are meant to complement human trainers, not replace them. Here are some points on what AI does and what human trainers do:

What AI Does:

Provides instant answers to policy-related questions.

Automates compliance training and reminders.

Simulates real customer conversations for practice.

What Human Trainers Do:

Offer personalized coaching and mentorship.

Handle complex training scenarios AI can’t manage.

Lead team discussions and role-playing sessions.

AI chatbots pull information from verified company databases, policy documents, and regulatory updates.

How to ensure accuracy further:

Train your chatbot with insurance-specific data, instead of general AI models.

Integrate AI with your CRM & compliance systems for real-time updates.

Set up human review processes for AI-generated responses.

Yes! AI chatbots don’t just train agents—they also help them close more deals.

Sales Coaching Features:

AI-powered role-playing to practice handling objections.

Instant policy comparisons to help agents suggest the best coverage.

AI-driven sales scripts to improve conversation flow.

Customer Support Features:

Handles common policy inquiries, reducing agent workload.

Transfers complex cases to human agents when needed.

Offers multilingual support for diverse customer bases.

IN YOUR BUSINESS FOR FREE

Our website require some cookies to function properly. Read our privacy policy to know more.