Basic AI Chatbot Pricing: A simple chatbot that can answer questions about a product or service might cost around $10,000 to develop.

Read More

TL; DR

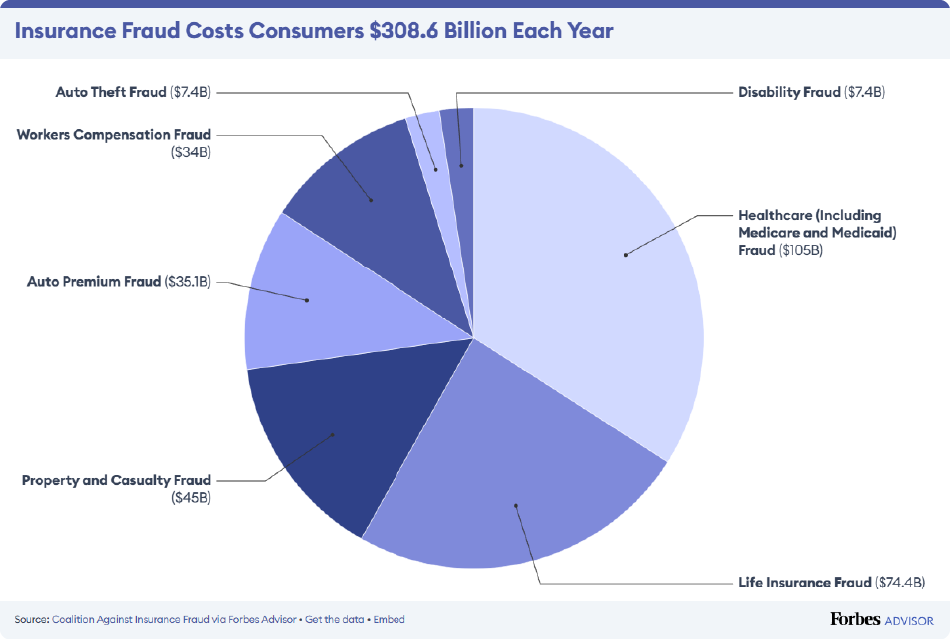

Insurance fraud costs the U.S. industry $308.6 billion annually, increasing premiums and financial instability.

AI-powered predictive analytics and machine learning identify fraud patterns before claims are processed.

Insurance chatbot development enables real-time fraud screening, verifying policyholder identity, and reducing false claims.

Generative AI strengthens fraud detection models by simulating fraud patterns and training AI to detect new fraud tactics.

AI insurance Fraud detection helps insurers automate claim risk assessments, ensuring faster processing of genuine claims.

AI app development companies in USA are helping insurers build AI-driven fraud prevention solutions that reduce financial risks.

Insurance fraud is a multi-billion dollar issue that raises premiums and disrupts insurer profitability. Fraudulent claims burden insurers with financial losses, making it essential for companies to adopt AI insurance fraud detection strategies.

In the U.S. alone, fraudulent claims cost the industry a staggering $308.6 billion annually across health, property, casualty, and auto insurance (Forbes).

Higher Premiums for Policyholders 📈: Fraud-related losses drive up premiums, forcing honest customers to pay more.

Operational and Compliance Burdens ⚖️: Fraudulent claims increase investigation and legal costs, making the claims process longer and more complex.

Regulatory and Financial Risks 💸: Insurance fraud affects profitability, forces stricter regulations, and disrupts industry stability.

✅ Yes! With billions lost annually, fraud significantly impacts insurers, forcing them to raise costs and slow down legitimate claims processing.

🚀 The Solution? AI insurance fraud detection can prevent up to 90% of fraudulent claims, saving insurers billions.

🔹 AI-powered automation helps insurers analyze claim data faster and detect fraud in real time (McKinsey).

🔹 Machine learning algorithms flag anomalies and suspicious patterns with high accuracy.

🔹 AI-driven fraud detection is expected to become an industry standard by 2030, significantly reducing fraud-related losses.

With AI insurance fraud detection, insurers can cut down on false claims, reduce losses, and process legitimate claims efficiently.

Detect fraud in real time with AI-driven fraud analysis and risk assessment.

Book an AppointmentInsurance fraud isn’t just an occasional incident—it’s a massive, global issue costing insurers hundreds of billions every year. Fraudulent activities range from fake claims and exaggerated damages to staged accidents and identity theft, all of which significantly impact insurance companies and policyholders alike.

Break down fraud losses by insurance type (health, auto, life, home).

Discuss how traditional fraud detection methods fail, leading to more than 60% of fraud cases going undetected.

Highlight manual processing inefficiencies, where fraud investigations take weeks, increasing insurer losses.

🔹 Fraudulent insurance claims cost the U.S. insurance industry a staggering $308.6 billion annually (Forbes).

🔹 Artificial intelligence adoption in insurance is growing rapidly, with AI-driven automation expected to significantly reduce fraud losses (Precedence Research).

🔹 AI-powered automation is increasingly being used in risk assessment, reducing manual intervention in fraud detection (McKinsey).

Source

Source

🔹 Auto Insurance Fraud 🚗:

Fraudulent claims, including staged accidents and falsified injuries, increase costs for insurers.

🔹 Property & Casualty Insurance Fraud 🏡:

Exaggerated damage claims and fraudulent repair invoices add billions in unnecessary payouts.

🔹 Life & Health Insurance Fraud 🏥:

Falsified medical claims and fraudulent beneficiary payouts continue to challenge insurers.

💡 Traditional methods often fail to detect sophisticated fraud schemes. AI insurance fraud detection provides insurers with advanced fraud-prevention models to tackle these evolving threats.

As fraudsters use advanced digital tools to manipulate claim documents, falsify reports, and evade detection, traditional fraud prevention methods are struggling to keep up.

💡 With AI-powered fraud detection, insurers can improve fraud detection accuracy, reduce financial losses, and prevent fraudulent payouts before they happen.

With billions lost annually, insurers rely on AI insurance fraud detection to identify fraudulent activities and minimize financial risks. AI-driven fraud detection improves claim verification accuracy, reduces false claims, and speeds up fraud investigations.

🔹 AI adoption in the insurance industry is growing rapidly, with nearly half of insurers planning to increase AI investments in fraud detection and risk assessment (Risk & Insurance).

🔹 The global artificial intelligence in insurance market is expected to grow at a CAGR of 33.06%, reaching $45.74 billion by 2032 (Precedence Research).

🔹 Insurers leveraging AI-driven automation can reduce claim processing time and fraud detection efforts significantly, improving overall operational efficiency (Infosys BPM).

AI insurance fraud detection analyzes past claim data and customer behavior to identify hidden fraud patterns, preventing suspicious claims before they reach the payout stage.

Machine learning algorithms flag anomalies by comparing claims against vast datasets, identifying fraud with greater speed and accuracy than human auditors.

AI-powered Natural Language Processing (NLP) scans claim reports, invoices, and policyholder information to detect inconsistencies and fraudulent activities.

AI can analyze images and videos submitted in claims, detecting fake accident evidence, staged property damages, or manipulated photos.

AI chatbots interact with policyholders during claims submission, using real-time data verification to flag inconsistencies in responses and document submissions.

💡 By leveraging AI fraud detection solutions insurance companies can reduce fraudulent payouts and enhance security measures.

✅ Reduces fraudulent claim payouts, improving profit margins.

✅ Speeds up fraud investigations, cutting manual workload.

✅ Enhances regulatory compliance, ensuring transparent fraud detection.

✅ Improves accuracy, reducing false positives and ensuring fair claim processing.

With AI for insurance fraud detection, insurers can prevent billions in fraud-related losses, streamline claim approvals, and safeguard financial stability.

AI reduces false claims and automates fraud detection. Start protecting your business today.

Schedule a CallA real-world example of AI automation in insurance is Biz4Group’s AI-powered chatbot, Insurance AI, which helps insurers improve training and policy assistance.

🔹 Client: A leading insurance firm looking to enhance agent training and policy guidance.

🔹 Challenge: Traditional training methods were time-consuming, inconsistent, and lacked real-time assistance.

🔹 Solution: Biz4Group developed an AI-powered chatbot, "Insurance AI," to revolutionize the training process.

✅ Provides real-time assistance 📞 – The chatbot offers instant support to insurance agents by answering queries about policies, procedures, and claims handling.

✅ Speeds up onboarding & training 📚 – Insurance AI helps new agents learn faster through AI-driven modules that reduce training time significantly.

✅ Ensures accuracy & compliance ⚖️ – AI automation ensures that agents always receive up-to-date and compliant responses, reducing human errors in policy explanations.

✅ Reduces operational workload 🚀 – With AI automating repetitive queries, insurers can allocate human resources to complex fraud detection and claim investigations.

💡 AI insurance fraud detection works alongside automation tools to strengthen fraud prevention efforts.

Although Insurance AI focuses on training and policy assistance, AI fraud detection solutions work alongside such automation tools to:

✅ Reduce fraudulent claims by detecting suspicious patterns in real-time.

✅ Identify inconsistencies in policyholder information to prevent identity fraud.

✅ Speed up claims verification by automating risk assessment and compliance checks.

📌 AI development services help insurers integrate AI into their fraud detection and training processes.

AI-powered insurance chatbot development provides real-time fraud screening, reducing the risk of fraudulent claims. Chatbots help insurers validate policyholder identity, analyze behavior, and flag inconsistencies.

📊 AI-powered chatbots are projected to handle 95% of customer interactions in insurance by 2025.

📌 AI insurance fraud detection integrated with chatbots prevents fraud before claims reach the processing stage.

💡 Automated chatbots streamline fraud detection by assisting insurers with fraud risk analysis, policy verification, and claim authentication.

AI chatbots verify customer details in real-time by cross-referencing data from policyholder databases and fraud detection tools. Fake identities and duplicate claims are immediately flagged.

Chatbots analyze uploaded documents using AI-powered OCR (Optical Character Recognition) to detect inconsistencies in claim reports, invoices, and medical records.

Advanced chatbots track user interactions and use machine learning to detect suspicious behaviors—such as inconsistent responses, excessive claims, or irregular payment patterns.

By integrating with fraud detection systems, AI chatbots instantly check claims against fraud databases, reducing manual intervention and improving fraud detection accuracy.

✅ Instant verification reduces fraudulent claims at the entry point.

✅ Speeds up claims processing, reducing delays and manual errors.

✅ Improves fraud detection by cross-checking policyholder history.

✅ Enhances regulatory compliance by maintaining detailed audit trails.

💡 With AI-powered chatbots, insurers can not only improve customer service but also strengthen fraud detection from the moment a claim is submitted.

Automate fraud screening and improve claim accuracy with AI-powered solutions.

Contact UsGenerative AI enhances AI insurance fraud detection by training fraud detection models using synthetic fraud scenarios. This helps insurers detect previously undetectable fraud patterns and strengthens fraud prevention.

📌 AI fraud detection solutions insurance providers use today are evolving with Generative AI to improve fraud risk predictions and claim validation accuracy.

Generative AI creates fake but realistic fraudulent scenarios to train fraud detection models, making them better at identifying real-world fraud attempts.

AI models analyze historical fraud data and generate new fraud variations, helping insurers stay ahead of fraudsters' evolving tactics.

Generative AI helps insurers develop detailed fraud risk profiles by predicting high-risk claimants before fraud occurs.

By generating fraud detection models in real-time, insurers can automate fraud case investigations and significantly reduce investigation costs and time.

✅ Detects previously undetected fraud patterns.

✅ Reduces false positives, improving claim approval accuracy.

✅ Speeds up fraud investigations, reducing manual workload.

✅ Prepares insurers for future fraud risks through proactive AI modeling.

💡 With Generative AI, insurance companies can detect fraud faster, minimize financial losses, and improve overall fraud detection efficiency.

AI-driven automation eliminates human intervention in fraud detection, reducing investigation time and increasing claim accuracy. Insurance automation software development enables end-to-end fraud detection with real-time claim assessment.

📌 AI insurance fraud detection automates fraud risk assessments, ensuring that high-risk claims receive immediate attention while genuine claims are processed efficiently.

💡 AI automation in insurance strengthens fraud prevention, reduces financial risks, and enhances insurer compliance.

AI automatically assigns fraud risk scores to claims, flagging high-risk cases for further review while fast-tracking legitimate ones.

AI seamlessly integrates with claims management systems, analyzing vast datasets to detect fraud without human intervention.

Automated fraud detection ensures full compliance with industry regulations, reducing legal risks and penalties.

AI continuously refines its fraud detection algorithms based on new data, improving accuracy over time.

✅ Reduces fraud investigation time by up to 80%.

✅ Cuts operational costs by automating fraud detection workflows.

✅ Improves fraud prevention accuracy, reducing false positives.

✅ Enhances regulatory compliance with AI-driven audits.

💡 As AI automation continues to advance, insurers that adopt AI-driven fraud detection will gain a competitive edge, minimizing financial losses while improving efficiency.

Insurance fraud is a multi-billion dollar problem, inflating costs for insurers and honest policyholders alike. With fraudulent claims costing the industry over $308.6 billion annually (Forbes), traditional fraud detection methods can no longer keep up with the growing sophistication of fraudsters.

💡 But AI is changing the game.

From real-time fraud detection and AI-powered risk assessment to Generative AI simulations and automated claim verification, AI has proven its ability to prevent up to 90% of fraudulent claims.

🚀 AI-driven fraud detection solutions are transforming the insurance industry, helping insurers prevent fraudulent claims, enhance risk assessment, and improve fraud detection accuracy.

📌 AI app development companies in USA help insurers develop AI-powered fraud detection tools that analyze claim data, detect anomalies, and reduce fraud risks.

📌 AI app ideas for fraud prevention allow insurers to build AI-driven fraud detection systems that automate risk analysis and claim validation.

💡 AI in insurance fraud detection is no longer optional—it’s a necessity for insurers aiming to improve fraud mitigation strategies and reduce financial losses.

AI-driven risk analysis helps prevent fraudulent claims before they happen.

Schedule a CallInsurance companies that fail to adopt AI-driven fraud prevention tools risk increased financial losses, delayed claim processing, and reputational damage.

📢 What’s Next for Insurers?

✅ Integrate AI-powered fraud detection models to reduce fraudulent claim payouts.

✅ Leverage AI automation in risk assessment and compliance to minimize regulatory risks.

✅ Adopt AI chatbots to strengthen fraud prevention at the customer interaction level.

✅ Utilize Generative AI in insurance to stay ahead of evolving fraud tactics.

💡 With AI, insurers can not only detect fraud more accurately but also optimize claims processing, improve customer trust, and reduce operational costs.

IN YOUR BUSINESS FOR FREE

Our website require some cookies to function properly. Read our privacy policy to know more.